Texas Ag Exempt Form

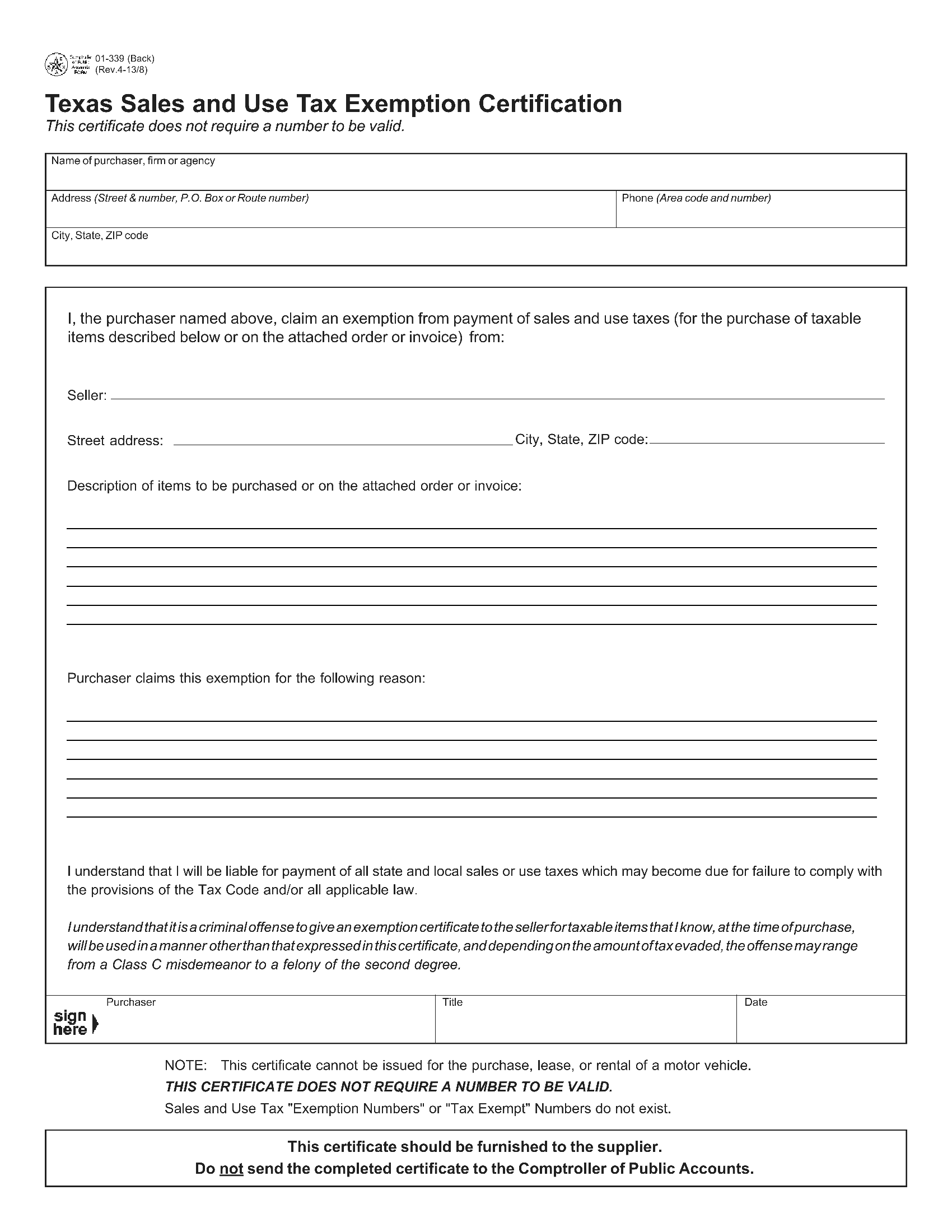

Texas Ag Exempt Form - This form is for producers of agricultural products for sale who claim exemption from sales and use tax on qualifying items. If you currently hold a valid texas ag timber number in texas you may be exempt from some texas taxes when purchasing items to use exclusively to produce agricultural products for sale. This blog covers all 254 counties and provides eligibility criteria, application processes and forms for. Search and find ag/timber registration information on the comptroller's website. Commercial agricultural producers must use this form to claim exemption from texas sales and use tax when buying, leasing or renting qualifying agricultural items they will use exclusively in. Download and print a certificate to claim an exemption from sales and use taxes for the purchase of taxable items in texas. The certificate does not require a number and does not apply to.

If your question is not. Download agricultural and timber exemption registration number form. Download and print a certificate to claim an exemption from sales and use taxes for the purchase of taxable items in texas. To reprint your confirmation letter and courtesy card.

Find out how to apply for agricultural exemption in texas and save on property taxes. Producers of agricultural products for sale must provide this completed form to retailers when claiming an exemption from sales. The certificate does not require a number and does not apply to. Who is eligible for an ag/timber number? This form is for producers of agricultural products for sale who claim exemption from sales and use tax on qualifying items. Select ag/timber account maintenance to update your current (active) exemption including:

Fillable Form St8f Agricultural Exemption Certificate printable pdf

These items are exempt from sales tax when used exclusively on a farm or ranch to produce agricultural products for sale and purchased by a person with a current ag/timber. This form is used to apply for a registration number that can be used to claim a sales and use tax exemption on qualifying items for agricultural and timber production. It lists the items that qualify or do not qualify for exemption, and. This application is used to obtain a registration number that can be used to claim an exemption from texas sales and use tax on the purchase of qualifying items used in the production of. The county appraisal district forms and documents that may be downloaded from our website are in adobe acrobat.

Can shoppers from foreign countries and other. This application is used to obtain a registration number that can be used to claim an exemption from texas sales and use tax on the purchase of qualifying items used in the production of. Producers of agricultural products for sale must provide this completed form to retailers when claiming an exemption from sales. To reprint your confirmation letter and courtesy card.

Texas Agricultural Sales And Use Tax Exemption Certification.

Select ag/timber account maintenance to update your current (active) exemption including: This blog covers all 254 counties and provides eligibility criteria, application processes and forms for. Can shoppers from foreign countries and other. Download and print a certificate to claim an exemption from sales and use taxes for the purchase of taxable items in texas.

To Reprint Your Confirmation Letter And Courtesy Card.

Download agricultural and timber exemption registration number form. Commercial agricultural producers must use this form to claim exemption from texas sales and use tax when buying, leasing or renting qualifying agricultural items they will use exclusively in. Who is eligible for an ag/timber number? Find pdf forms for applying for and claiming exemptions from sales, motor vehicle and fuels taxes for agricultural and timber activities in texas.

To Claim A Tax Exemption On Qualifying Items, You Must Apply For An Agricultural And Timber Registration Number (Ag/Timber Number) From The Comptroller.

Commercial agricultural producers must use this form to claim exemption from texas sales and use tax when buying, leasing or renting qualifying agricultural items they will use exclusively in. Who is not eligible for an ag/timber number? The county appraisal district forms and documents that may be downloaded from our website are in adobe acrobat. How do i claim the agricultural sales tax exemptions?

This Form Is Used To Apply For A Registration Number That Can Be Used To Claim A Sales And Use Tax Exemption On Qualifying Items For Agricultural And Timber Production.

Producers of agricultural products for sale must provide this completed form to retailers when claiming an exemption from sales. The certificate does not require a number and does not apply to. This application is used to obtain a registration number that can be used to claim an exemption from texas sales and use tax on the purchase of qualifying items used in the production of. If you currently hold a valid texas ag timber number in texas you may be exempt from some texas taxes when purchasing items to use exclusively to produce agricultural products for sale.

Select ag/timber account maintenance to update your current (active) exemption including: This form is for commercial agricultural producers to claim exemption from texas sales and use tax when buying, leasing or renting qualifying agricultural ite… Download and print a certificate to claim an exemption from sales and use taxes for the purchase of taxable items in texas. To reprint your confirmation letter and courtesy card. The certificate does not require a number and does not apply to.