Deed Of Trust Template

Deed Of Trust Template - • _____ [name] a/an (check one) ☐ individual ☐ _____ _____ [entity type] incorporated under the laws of _____ [state] Deed of trust this deed of trust (this “trust deed”) is made as of the _____ day of _____, 20_____ (the “effective date” by and among: Some states require this deed when buyers use financing to purchase a home. If the borrower does not repay the loan on time, the lender can use this document to foreclose on and sell the property in order to pay off the outstanding balance of the loan. It transfers the property’s legal title to a neutral third party , the trustee,. For this purpose, borrower irrevocably grants and conveys to trustee, in trust, with power of sale, the following described property located in the _______________________________ of ______________________________________: Warranty deed forms are forms used wherein a grantor offers the guarantee of holding a clear title on his property or real estate that is to be conveyed to the grantee.

Warranty deed forms are forms used wherein a grantor offers the guarantee of holding a clear title on his property or real estate that is to be conveyed to the grantee. • _____ [name] a/an (check one) ☐ individual ☐ _____ _____ [entity type] incorporated under the laws of _____ [state] A house, plot of land, farm, etc.) to serve as security or collateral for a loan. For this purpose, borrower irrevocably grants and conveys to trustee, in trust, with power of sale, the following described property located in the _______________________________ of ______________________________________:

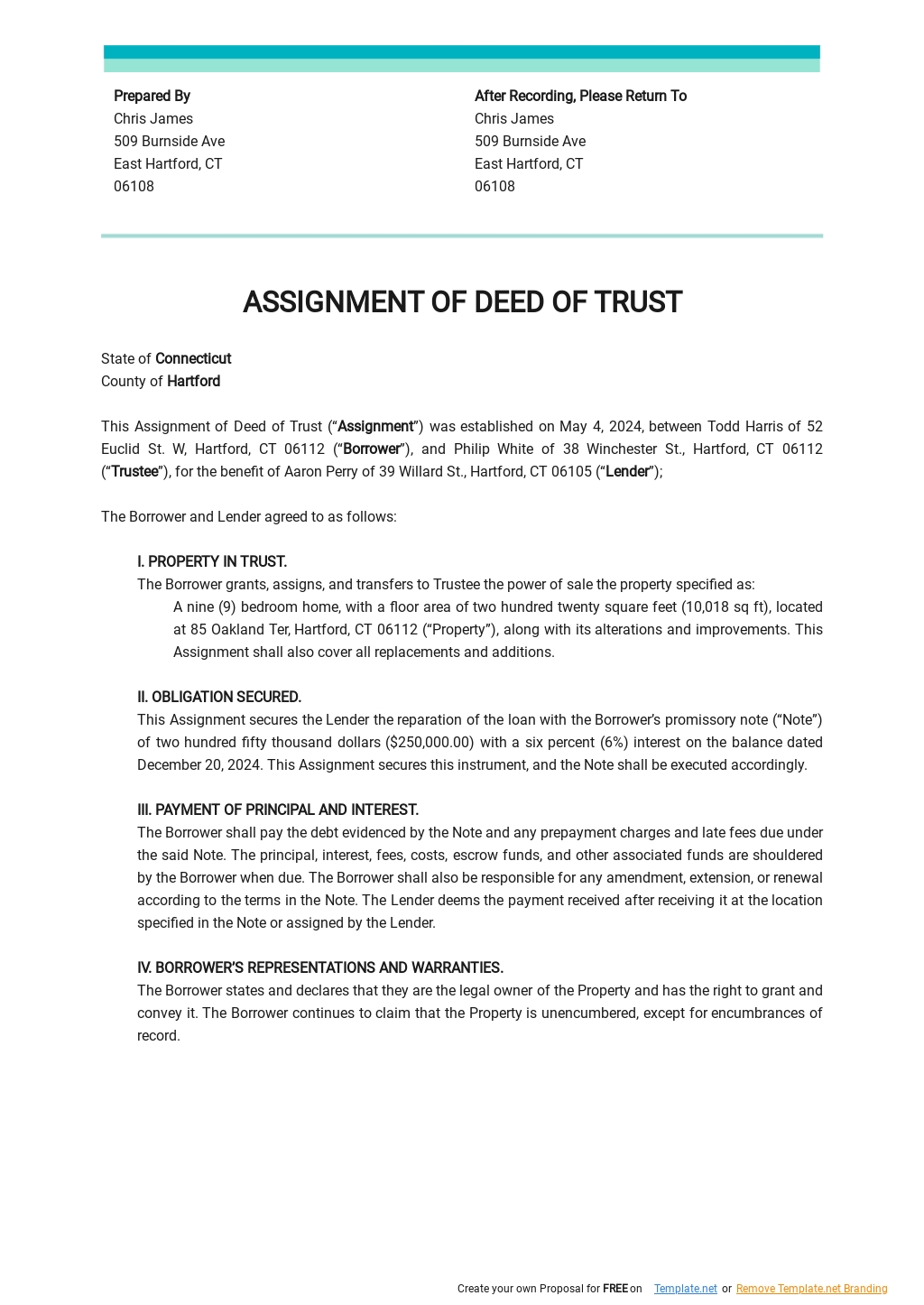

A deed of trust is the document that is drafted when a lender loans a borrower money to buy a property or a home. They include important sections including the power of sale, payment terms, tax and insurance requirements, and promissory note. [type of recording jurisdiction] [name of recording jurisdiction] It transfers the property’s legal title to a neutral third party , the trustee,. The borrower agrees to give security in the loan by granting the legal title of the property to the lender. Deeds of trust are part of the paperwork involved in buying property in many states.

Depending on where you’re purchasing property, you may need this deed to proceed. They include important sections including the power of sale, payment terms, tax and insurance requirements, and promissory note. Download a deed of trust form to record a relationship between a borrower, lender, and trustee to ensure a borrower repays a property loan. We have sample trust of deed forms provided below in which you can download and fill them out for free for your personal and future intents. Otherwise, they forfeit their property.

A deed of trust, also known as a trust deed, is a document used during financed real estate transactions, meaning a buyer borrows money from a lender to buy a property. Warranty deed forms are forms used wherein a grantor offers the guarantee of holding a clear title on his property or real estate that is to be conveyed to the grantee. The borrower agrees to give security in the loan by granting the legal title of the property to the lender. Deed of trust this deed of trust (this “trust deed”) is made as of the _____ day of _____, 20_____ (the “effective date” by and among:

Download A Deed Of Trust Form To Record A Relationship Between A Borrower, Lender, And Trustee To Ensure A Borrower Repays A Property Loan.

Warranty deed forms are forms used wherein a grantor offers the guarantee of holding a clear title on his property or real estate that is to be conveyed to the grantee. They include important sections including the power of sale, payment terms, tax and insurance requirements, and promissory note. A deed of trust is a document used to create a lien on a piece of real property (e.g. It transfers the property’s legal title to a neutral third party , the trustee,.

A Deed Of Trust, Also Known As A Trust Deed, Is A Document Used During Financed Real Estate Transactions, Meaning A Buyer Borrows Money From A Lender To Buy A Property.

We have sample trust of deed forms provided below in which you can download and fill them out for free for your personal and future intents. For this purpose, borrower irrevocably grants and conveys to trustee, in trust, with power of sale, the following described property located in the _______________________________ of ______________________________________: If the borrower does not repay the loan on time, the lender can use this document to foreclose on and sell the property in order to pay off the outstanding balance of the loan. • _____ [name] a/an (check one) ☐ individual ☐ _____ _____ [entity type] incorporated under the laws of _____ [state]

The Deed Of Trust Acts As Security For A Promissory Note, A Form That Establishes The Borrower’s Obligation To Pay Back The Loaned Amount In Full.

A house, plot of land, farm, etc.) to serve as security or collateral for a loan. A deed of trust is an agreement formed between a buyer of real estate, a lender financing the purchase, and a neutral third party called the trustee. A deed of trust is the document that is drafted when a lender loans a borrower money to buy a property or a home. Deed of trust this deed of trust (this “trust deed”) is made as of the _____ day of _____, 20_____ (the “effective date” by and among:

Deeds Of Trust Are Part Of The Paperwork Involved In Buying Property In Many States.

Depending on where you’re purchasing property, you may need this deed to proceed. Some states require this deed when buyers use financing to purchase a home. The borrower agrees to give security in the loan by granting the legal title of the property to the lender. [type of recording jurisdiction] [name of recording jurisdiction]

The borrower agrees to give security in the loan by granting the legal title of the property to the lender. Some states require this deed when buyers use financing to purchase a home. A deed of trust is an agreement formed between a buyer of real estate, a lender financing the purchase, and a neutral third party called the trustee. A house, plot of land, farm, etc.) to serve as security or collateral for a loan. [type of recording jurisdiction] [name of recording jurisdiction]